The Future of Trading Agents: From Intelligence to Collaboration

#55 - Behind The Cloud: From Agents to Allies - The Rise of Collaborative Intelligence in Quant Investing (4/4)

The Future of Trading Agents: From Intelligence to Collaboration

September 2025

From Agents to Allies – A Series by the Omphalos Research Team

In this four-part series, the Omphalos Research Team explores the growing role of agentic AI in systematic investing. From today’s signal-generating trading agents to tomorrow’s intelligent, aware, and collaborative agents, we examine how multi-agent systems can reshape decision-making in finance.

The new series of Behind The Cloud offers a behind-the-scenes look at how Omphalos Fund uses AI not as a black box, but as a modular, scalable framework for robust and adaptive trading – and what comes next as portfolios learn to think and act as one.

The Future of Trading Agents: From Intelligence to Collaboration

In the first chapters of this series, we introduced the concept of agentic AI and walked through the architecture of today’s Omphalos Fund: a system of hundreds of specialized AI agents that generate trading signals — each operating independently, with decisions strictly constrained by hardcoded investment logic and risk rules.

But what if some of that logic could evolve?

What if trading agents could begin to adapt certain aspects of their strategy — not just generate predictions?

What if they became aware of what other agents in the system are doing?

And what if, over time, they began to collaborate, coordinating toward a shared performance goal?

This final chapter explores our vision for the next generation of trading agents: intelligent, aware, and collaborative — while still operating under strict oversight and guardrails.

Step 1: From Executing Strategies to Adaptive Decision-Making

At Omphalos, trading agents already go beyond simple signal generation. Each agent follows a defined investment strategy and has the authority to execute trades directly, always within the boundaries set by the system’s global risk and capital rules.

The next step is to give these agents more room to adapt their own decision logic. Instead of applying their strategies rigidly, they could begin to evaluate and refine parameters in real time — for example:

- Adjusting trade frequency or position sizing based on recent signal reliability or changing volatility conditions,

- Dynamically shifting entry and exit thresholds when market regimes switch,

- Temporarily pausing execution if their performance deteriorates beyond predefined tolerance levels.

In parallel, we are also implementing the ability for a single trading agent to operate across multiple assets, expanding its scope while still maintaining strategy-specific guardrails.

This is not about removing guardrails. Exposure caps, diversification limits, and drawdown protections remain fixed. But within those boundaries, agents gain the ability to self-optimize, learning from their own track record and the surrounding market environment.

Why this matters: rigid systems can struggle when conditions change abruptly. Agents that can adapt within strict limits are better equipped to capture opportunities and avoid risks, without requiring a redesign of the whole platform.

Real-World Precedent: Many modern quant funds already use meta-models to adjust strategy weights or execution speed. But using LLMs or agentic models to control these parameters — based on historical self-assessment or peer review — opens new possibilities for adaptive portfolio intelligence.

Step 2: Agent Awareness – Seeing the Bigger Picture

Today, each Omphalos agent executes its strategy independently, guided by its own model and time horizon. This independence ensures diversity and reduces systemic bias — but it also creates blind spots. Without awareness of the broader portfolio, agents can:

- Open overlapping positions in correlated assets,

- Concentrate too much risk in a single sector or region,

- Or even cancel out each other’s efforts by trading in opposite directions.

The next step is to give agents contextual awareness of what’s happening across the system. Instead of acting in isolation, they could access anonymized summaries such as:

- Current portfolio exposures by asset class, sector, or geography,

- The number and type of active positions already in play,

- Concentration of drawdowns or areas of correlated risk.

Crucially, this doesn’t mean agents are yet “cooperating.” Each still acts on its own logic. But awareness allows them to adjust their actions with a clearer sense of the whole. An agent that sees the system is already heavily exposed to a region, for example, might downscale its position rather than add to concentration.

Why this matters: Awareness preserves diversity while reducing redundancy and hidden risk. It helps agents act not just as specialists, but as informed contributors to the resilience of the overall portfolio.

Research Insight: In recent lab simulations, Omphalos researchers found that introducing simple portfolio-awareness to agents led to a 20% reduction in signal overlap, improving overall diversification without any central planner.

Step 3: Collaboration – Toward Collective Intelligence

Once agents not only adapt but also gain awareness of the system as a whole, the natural next step is collaboration.

In this model, agents are not just aware of each other — they communicate and share plans.

That could mean:

- Sharing planned trades with others before execution, so potential conflicts or synergies can be flagged

- Submitting strategies to peer review from other agents

- Negotiating timing or scaling of positions to align with broader portfolio goals

This moves from independence to coordinated intelligence, creating a system where agents optimize not just their own success, but the performance of the total portfolio.

Importantly, collaboration doesn’t require central control. It’s more like a multi-agent consensus: each agent acting locally, but in a way that improves global outcomes.

Inspiration: Systems like swarm robotics, decentralized routing, and even real-time multiplayer games have shown how local communication rules can produce global optimization — without a master controller.

Internal Prototyping: Early-stage simulations at Omphalos have tested “agent clusters” with shared objectives (e.g., minimizing volatility across sectors or improving Sharpe ratio over 30-day windows). These experiments showed a 4–5% improvement in net performance versus independent baselines, with no central planner involved.

External Validation: A recent article by Devang Vashistha further supports this direction. In his multi-agent trading framework, each agent adopts a role — fundamental analyst, technical analyst, sentiment researcher, trader — and decisions emerge from structured interactions among these roles. In simulated environments, this multi-agent team outperformed traditional trading models in both return and risk metrics.

“We implemented analyst-debate workflows that mimic how real trading desks operate — and the result was higher confidence and better execution outcomes.”

— Devang Vashistha, Multi-Agents + LLMs: A Financial Trading Framework

This kind of research reinforces our belief that collaboration among agents — when well-structured and goal-aligned — can unlock genuine alpha. It’s not about replacing investment teams. It’s about recreating team dynamics inside intelligent systems, with auditability and oversight built in.

Guardrails Still Matter

As agents gain intelligence, awareness, and the ability to collaborate, the need for control and accountability doesn’t go away — it becomes even more important.

That’s why Omphalos is committed to:

- Fixed outer boundaries for exposure, risk, and capital usage

- Transparent decision logging for every agent, in human-readable format

- Fail-safe protocols that freeze agent execution in the event of anomaly detection

- Human-in-the-loop auditing for all new agent behaviors before deployment

We’re not building autonomous robots. We’re building cooperative systems — engineered to be adaptable, but never opaque.

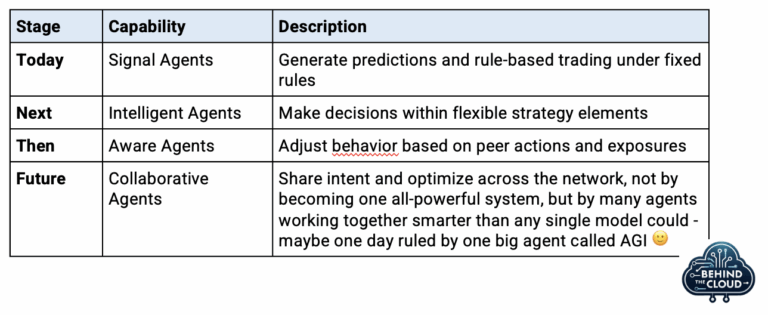

From Forecasting and Rule-Based Trading to Coordination

Let’s recap the evolution:

Each stage adds complexity — but also resilience, adaptability, and potential for alpha.

Why It Matters Now

Financial markets are increasingly defined by speed, complexity, and interconnectedness. In such an environment, the ability to act with nuance — to sense context, weigh trade-offs, and coordinate across strategies — becomes a competitive edge.

We believe the next major performance breakthrough won’t come from one smarter model. It will come from a smarter system — one that is:

- Modular and scalable

- Transparent and controlled

- And able to think together

That’s what we mean when we say: From agents to allies.

Thanks for following this series.

To learn more about our architecture, research, or institutional partnerships, visit www.omphalosfund.com or reach out to our team.

Stay tuned for our series in Behind The Cloud, where we’ll continue to explore the frontiers of AI in finance.

If you missed our former editions of “Behind The Cloud”, please check out our BLOG.

© The Omphalos AI Research Team – September 2025

If you would like to use our content please contact press@omphalosfund.com